The Australian Prudential Regulation Authority (APRA) has been keeping a very close eye on the nation’s $2.3 trillion superannuation pool of savings and on 1 February 2017 it released three data sets detailing both overall sector performance and fund level analysis for MySuper products.

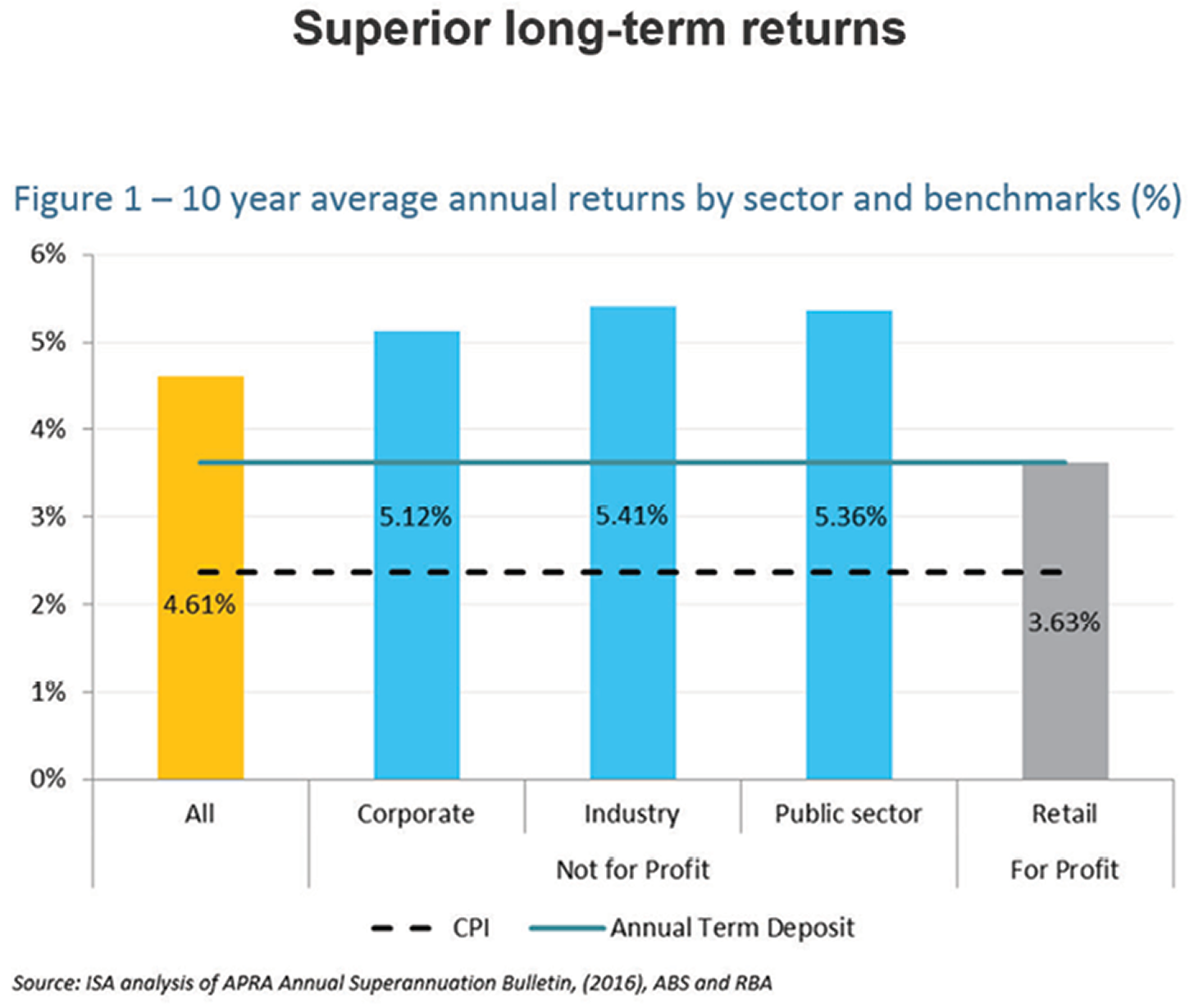

As the chart below illustrates, not for profit industry funds outperformed all other sectors with an average 10 year annual return of 5.41%. Public sector funds (covering public sector employees) came in a close second with a return of 5.36%, while corporate (employer) funds returned on average 5.12%. For profit retail funds were the lowest returning funds with a 10 year average annual return of just 3.6%. If you do the numbers including the loss of 10 years compound interest, you will be able to see just how much the underperformance was between industry funds and retail funds (see graph).

Not unsurprisingly, the data also showed that the funds offering more investment options deliver the lowest returns. In essence this means that members pay for the extra ‘bells and whistles’ from their returns. Funds which fit into the most investment options category are generally retail funds.

As well as providing megadata on super fund performance, APRA also expressed serious concern about the worst performing super funds over one, five and 10 year periods. The regulator looked at the lowest performing 25 funds out of our largest 250 funds. The Australian Financial Review reported on 16 February 2017 (Boot for worst super boards) that APRA has identified the worst performing funds and has put them on notice to improve their performance or close shop.

APRA is obviously concerned about consistent underperformance and has indicated that it will put more pressure on boards to make ‘hard decisions’ in the best interest of their members.

APRA’s deputy chairman, Helen Rowell, said, “Funds have had enough time to bed down administrative and regulatory changes. The next step is for (underperforming) funds to improve performance or exit the industry”.

So it’s very good news on the industry fund front and also good news that a number of consistently underperforming funds have been put on notice by the regulators. Superannuation analysts agree that the industry will undergo consolidation to take advantage of the economies of scale and many smaller or underperforming funds will disappear.

And some good news for NGS Super members – your fund has been nominated as a finalist in the category of Medium Fund of the Year ($5 billion to $10 billion in assets) for the Conexus Superannuation Awards 2017. The winner has not been determined at the time of writing.