On 31 August, the Australian Prudential Regulation Authority (APRA) published the results of its performance test for superannuation funds that was implemented as part of the Your Future, Your Super legislation. This legislation was designed to guide the super industry to improve its efficiency, transparency and accountability, allowing members to have a clear view of whether their fund is meeting their needs.

What was the test?

This was the first iteration of what will be an annual performance test, measuring performance, fees and costs of the MySuper (default) products provided by superannuation funds. You can find more details about the test on the APRA website (apra.gov.au). Your super represents a significant investment over your working life, and it is vital that it is well-managed, to ensure that your retirement savings are adequate for a comfortable life post-work.

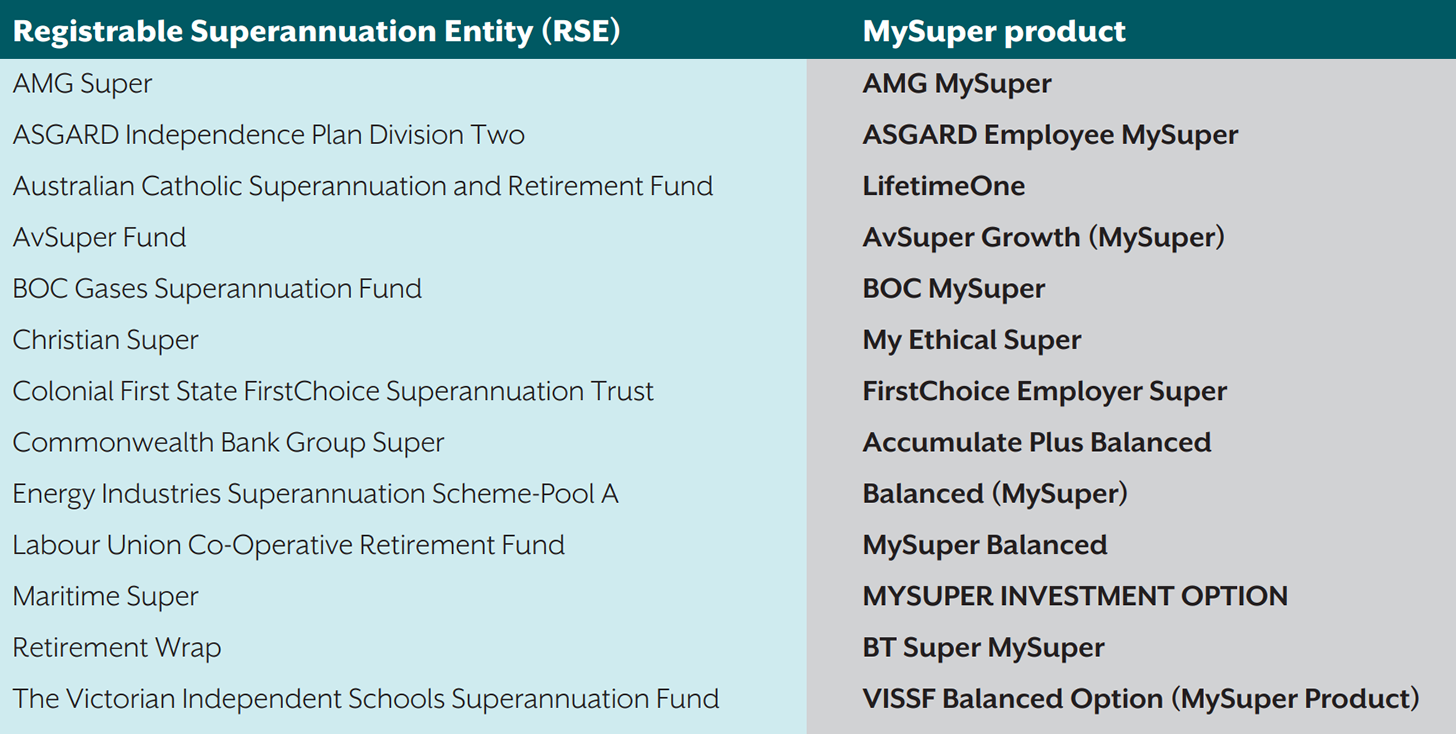

Which funds have products that failed?

The table included here shows the funds with products that failed the performance test.

What happens next?

The funds whose products failed the performance test are required to contact their members and advise them. Those products will be tested again next year, and if they again fail, they will no longer be able to accept new members.

What if I get the letter?

If you’re a member of one of the funds and have money invested in a product that has failed the performance test, your fund will write to you advising of this, and suggesting that you investigate other options. When you receive the letter, you may decide to move your money to a different fund. If so, you would want that fund to have passed the performance test and you may prefer a fund that has been designed for educators. If you are interested in exploring other super fund options, you can use the ATO YourSuper Comparison tool on the website (ato.gov.au).

What should I consider?

There are several things you should consider before changing your super fund, including what insurance cover you have in your current fund.

We’re not licensed to provide financial product advice, so we have asked NGS Super (the IEUA NSW/ACT Branch appoints three directors to the Board of NGS Super) to help union members with their enquiries. NGS is licensed to provide general and limited personal advice about superannuation, you don’t have to be a member to get assistance and there’s no obligation to join.

To make an appointment for an NGS Super specialist to call you about your superannuation options, call the NGS Helpline on 1300 133 177, 8am to 8pm, Monday to Friday.